One doesn’t need to be an economist or savvy in finance to see that prices are climbing. In a nutshell, inflation is the increase in the money base or the amount of money in existence. Rising prices are but a symptom of this process of devaluing our money.

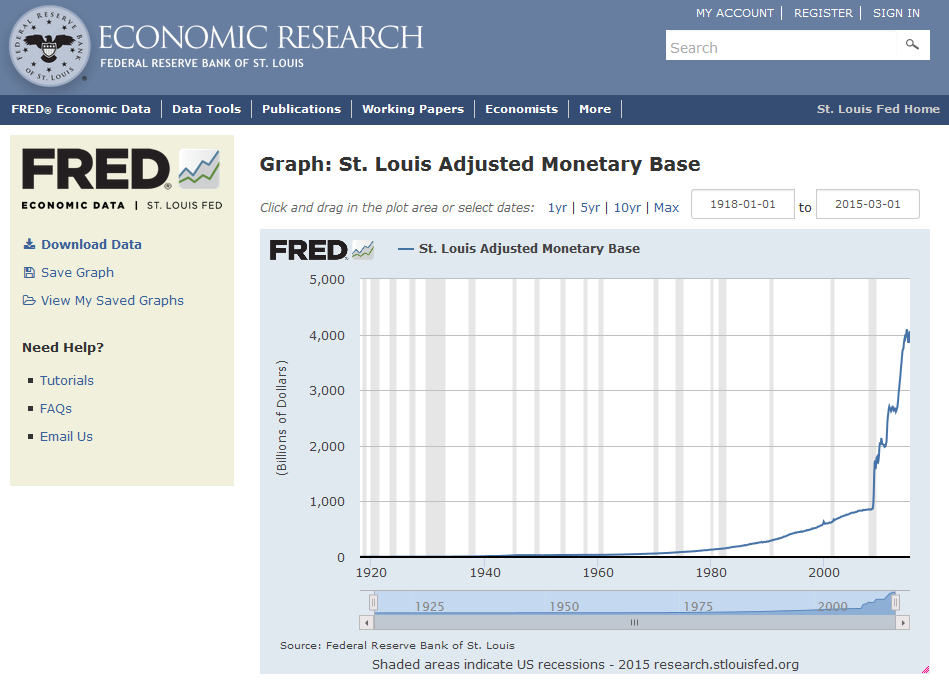

This is a chart from the St. Louis Federal Reserve. It is the job of that branch of the Fed to track and report the money supply. As you can see, the money base has been inflating since the early 1970s when Nixon took the U.S. off the gold standard, allowing unfettered money creation.

Now that our dollars no longer represent the value they once did, such as a piece of paper exchangeable for gold or silver, they are called Federal Reserve Notes. Note is another term for an IOU. In addition to these notes, ‘money’ has been created in many forms of electronic debt, resulting in the shenanigans we have today and the inevitable disastrous outcome.

As a consequence to us, the little guys, our dollars don’t stretch nearly as far in terms of buying what we want and need. Over the years this enormous inflation has largely been buffered as America has been successful in exporting the worst of the effects of money creation to other places, mostly developing countries. We have been able to do this because the U.S. Dollar has been the world’s reserve currency, which means at the end of each day almost all nations settle international trade in dollars.

If you have been following the alternative financial media, you know the world is step by step methodically detaching itself from using the U.S. Dollar as its reserve currency. The major countries are creating and operating with new money systems that marginalize the U. S. Dollar. We have not even felt the brunt of what this portends for us in the States. But it’s coming.

It is the general opinion in the Cog household that this process of the world dumping the U.S. Dollar is going to take quite a long time. While there will be ‘events’ that will send people running to the banks and losing a great deal of their perceived wealth, we think the dollar will continue to be diluted at the very least for several more years, perhaps a great many more.

As financial events occur, the Fed will resume ‘printing’ (it’s actually electronic now) and eventually we will experience hyperinflation. The purchasing power of our dollar will rapidly diminish and everyone will be affected. Since all the world's major central banks are also printing their own currency, this may well be a global phenomenon from which there are few if any places to hide.

Our personal solution to this approaching inflation is to not need money to the furthest extent possible. This is exactly the opposite of everything our society tells us to do. It requires swimming against the tide and most are not willing to make that physical and emotional leap... yet. But as more ‘bad news’ dribbles out into the mainstream media, people are slowly coming to grips with the fact that this is more than 'just' a difficult financial time to tough it through. It is a game changer.

The first big change we made was to physically relocate to a place where we could better provide for ourselves. Most rural homes have independent septic and wells for water, thus eliminating those utility costs. Having some elbow room to garden and plant trees and perennials is essential to helping supply your own affordable and nutritious foods. Many country locales have lax or no zoning rules, thus permitting livestock, trash burning and on-site target practice with firearms, resulting in a further reduction in 'money' needs.

Getting out of debt cut our expenses in half. While some people are not in a position to do this, more than half the country is still employed and have retirement funds and investments. Regulations and penalties make it tough to cash out of these without steep taxes and penalties, but we could stomach walking away with 50% to 70% of all we had. On the flip side continuing to own 100% of not very much (down the road) isn’t very much.

Now, we could be completely wrong about the debt. There is historical precedent for the governments and banks to declare a “debt jubilee” forgiving or cutting in half the amounts owed. Some would say this is a gamble worth taking. Others feel that even if the debt is not forgiven, it will be easy to pay it off down the road as the real value of that debt also diminishes with the value of the U.S. Dollar. These are not risks we are willing to take. On the whole, gambling in the modern world of finance isn’t working out so well for the little guys like us.

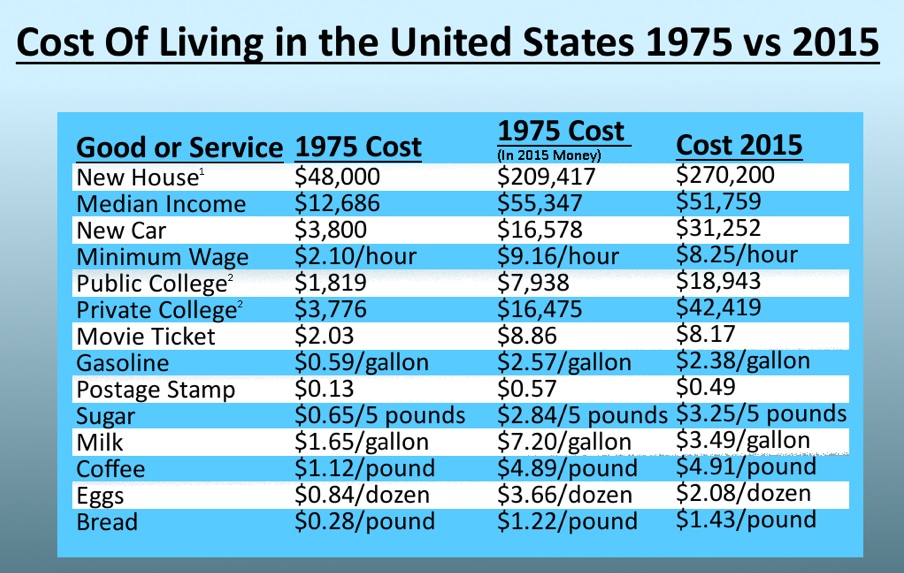

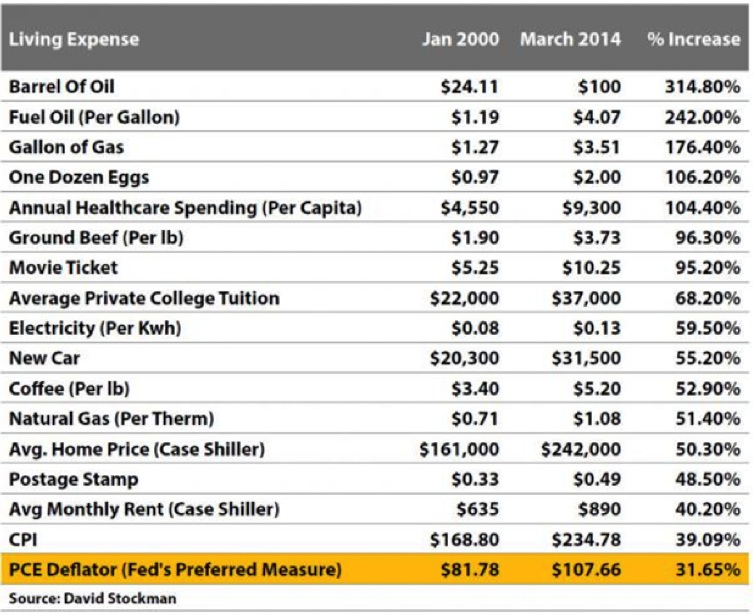

Aside from physically placing yourself in a location to better operate and getting out of debt to the greatest extent possible, let’s examine other costs of living that have affected Americans over the past 14 years.

Other areas where the ‘need for money’ can be decreased or eliminated include electricity and heating costs. When these prices really take off, so will the cost to invest in alternatives. Just developing energy saving habits around our home has made a difference in the power bill. Did you know appliances and other electronic devices steal electricity even when they aren’t being used?

After considering the costs for housing, utilities and debt, this leaves insurance, gasoline and what I call the replaceable items. Barring the few resourceful country folks I’ve met who actually converted trucks to run on homemade diesel from frying oil, gas costs are what they are. Planning trips out and consumption however, is well within your control to alter.

Insurance for auto is a necessity, as is homeowners insurance or renters insurance. Health insurance seems to be everyone’s bane, as prices skyrocket and quality healing services plummet. Many opt to go without. We choose catastrophic coverage in case of a medical emergency.

This leaves replaceables, substitutes and stocking up. What we purchase for our daily living is largely optional and often replaceable by our own hands. Here is a list of some of the more obvious which you may want to consider now while your dollars still have some purchasing power.

Some replacements are one time costs. Planting blueberries, blackberries, and strawberries can give yields for freezing and jams and use all year long. Nut and fruit trees as well can produce large hauls in just a few years time. Perennial medicinal herbs help immensely. Bandanas and handkerchiefs rather than tissues, cloth napkins instead of paper, ample kitchen towels rather than paper towels all can be used now or stowed for future use. Hand tools to use in the garden, water bath and pressure canners, mason jars and a solar oven can be used indefinitely. Even if we are not proficient in using these items now, they could make all the difference down the road.

Substituting affordable provisions is also a good idea. Most cleaning products and many toiletries and personal care products can be replaced with baking soda, still available for less than $8 per 12 pound bag. The ideas and suggestions for alternative and old-fashioned methods of meeting all our consumer needs are widely available on the internet.

I frequently suggest that people carefully examine their shopping carts while making purchases. How could each item be substituted with something you might supply yourself? What could you use or consume instead?

Allow me to draw your attention to certain items which are rising in cost at a ridiculous rate and you may want to make sure you have them on hand in sufficient quantities before prices rise even more. These include a good pair of scissors, Dawn dish-washing liquid, extra gasoline cans, and simple sewing supplies.

Other items have not risen proportionately to other costs, and you might consider doubling up on some of these. For example, I have a relatively inexpensive pair of steel toed work boots. They seem to wear well and I have worn my current pair for two years with several more years expected. When I found them on sale for $30, I bought two more pairs and stowed them away. Similarly, I have stored away extra socks and underwear, remembering what happened to cotton prices during the last financial crisis.

Aside from eliminating some needs for money and finding affordable alternatives for others, there is the matter of buying things in the turbulent future. It is said gold is for preserving wealth, but silver is for preserving your purchasing power.

It is no secret that markets are manipulated and thus it is widely known (unless you only watch CNBC and read the Wall Street Journal) that precious metals, including silver, have had their prices suppressed to ridiculously low levels. Speculative reasons for this abound. It gives the central banks and the uber-wealthy an opportunity to fill their coffers at almost rock bottom prices. It also serves to constrain the alarming financial signal that something is terribly wrong with the economy by letting the price of precious metals reflect the actual underlying degrading fundamentals. Essentially the smoke alarm has been turned off rather than simply putting out the fire.

Either way, silver is available for us to buy and take physical possession of. Keeping it in a secure vault or safety deposit box runs the risk of another entity potentially keeping you from accessing what is yours when it is most important. This is referred to as third party risk and is something you want to avoid at all costs when the rules are being changed without notice.

Avoiding all of the pain of unconstrained money printing and the erosion of your purchasing power for yourself and your family may be impossible. But with some careful forethought and out-of-the-box thinking, there are many steps you can take which will lessen the effects of these enormous changes not fully experienced in America in over three generations. Preserve and use your purchasing power wisely while there is still time to maneuver.