By

Casey Stengel

From the moment we landed in Beijing a year and a half ago I have worked to understand more about the real estate market in China, and more specifically the market in our second tier southern city. Many of my Chinese colleagues at the university have recently purchased a house or are in the process of doing so. Their comments about buying a house are many and varied. Some, who are first generation off the farm, are bewildered by the process and the price. Others, who are a bit more real estate savvy, are already figuring out how to get around the laws against owning more than one house even using a mortgage comparison website to find what they need to get buy their home.

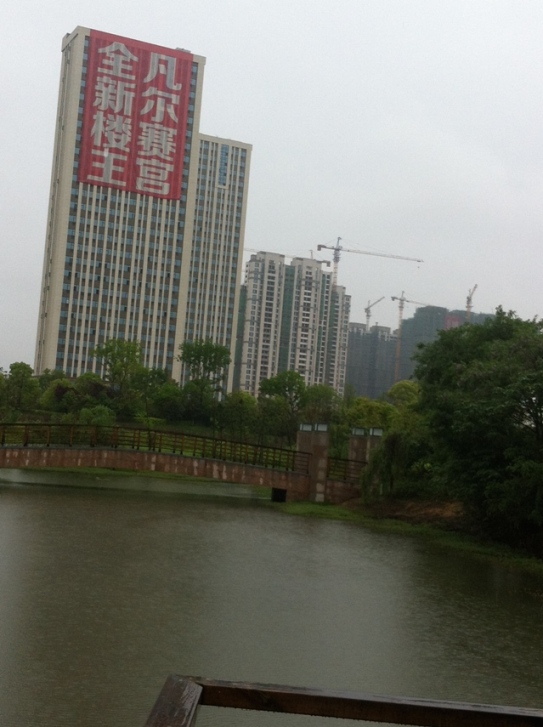

For those readers in the US we should clarify some terms. When Chinese people talk about buying a house, and when we discuss the housing boom, we should have a picture of an ‘apartment’ in our minds. Individual houses like those found in American suburbs are not being built. The government is carrying out a policy of urbanization and the cities here are growing larger. Suburbs look like small cities on the outskirts of big cities. Urban sprawl does not include subdivisions with split levels, front yards, lawnmowers and mini vans. A subdivision here looks like a cluster of 8 to 10 twenty five story high rise apartment buildings. Some subdivisions have 2-3 story townhouse buildings scattered throughout the high rise complex.

Recently as we took a taxi from our campus to the center of the city, a 7 kilometer drive, I counted fifty five tower cranes situated on new construction sites. These projects ranged from those which are two months from completion to those which are not even out of the ground. There are a lot of construction sites and I could only wonder at there safety regulations that had been put in place for workers and pedestrians, just in case anything were to happen. Construction accidents can happen from time to time, that's why it is now so easy to get an attorney to help you if you are injured. A total of fifty five projects just along one main road leading into the city. There is a whole new section of the city across the river that is growing even faster. I have never seen the scale of building construction anywhere to match this and it appears to be mostly residential construction. Reports of a slowdown in the residential construction market are beginning to surface from some big cities, but the construction boom will continue in our city for at least another two years.

My Chinese friends tell me that houses are expensive. In our second tier city, prices range from 8,000 to 10,000 Renminbi (rmb) or $1,280 to $1,600 per sq meter. This is for new construction and it does not include anything but a concrete shell with windows and doors as well as plumbing and electrical rough in. You want it ready to live in? They call that decorating and it will cost you another 200,000 to 800,000 rmb ($32,000 to $128,000) depending on your tastes. Tile floor, light and plumbing fixtures, appliances and draperies can increase the sq meter price significantly. In fact, when everything is added up the cost is out of reach for most Chinese people.

So who is buying? Investors, many of which are small time mom and pop types who see an opportunity. Unfortunately they failed to get the memo saying the big run is almost over and they bought near the top. Consider Iris who took the profits from the sale of her first house and plowed them into a house being built next to the campus where I teach. She put 50% down and can easily make the mortgage payment of 2100 rmb ($336) per month. However she can’t afford to decorate the house which is not a problem because she already has an apartment on our campus. She says she will let her future husband pay for the decorating. I hope she has a long term vision for her investment because she stands a good chance of being underwater in the near future.

Wanting to get the real scoop on what is out there I charged my phone, started the Google translate app and went out house shopping. An American in his mid fifties dressed for success is welcome to look around and kick the tires. I focused on the two-story town homes next to the high rise houses. They were stylish on the exterior, and the landscaping would be acceptable anywhere in the USA and was in fact quite beautiful. Inside they were plain cold concrete walls and stairs. The layout was open and if you could imagine the finished project they seemed like a nice place to live.

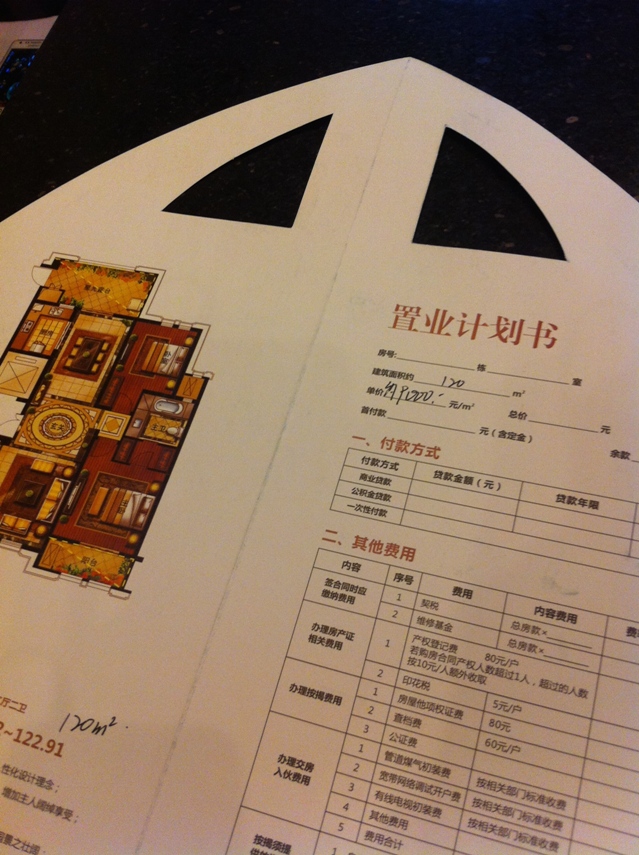

I wandered on over to the sales office located in the clubhouse. After establishing that I didn’t know much Chinese and the sales lady didn’t speak English we got down to business. I suspected she could read, but not speak English, which was in fact true. I would write some things and then go to Google translate for the more difficult words. She got out a sales brochure and started filling in the vital info. 120 sq meters, 9000 rmb ($1,440) per sq meter. Simple enough. “Decorating and financing was my job. She was only there to close the deal.” (Ok I imagined the last part because I had no idea what she said at the end.)

Quickly enough I figured I could have a nice place to live for about $210,000 USD. Not bad really, by US standards at least, but what about local folks? This is the part that loses me. I just don’t see an unlimited number of people here who can shell out 600,000 rmb ($96,000) for the down payment on a 1.2 million rmb ($192,000) house. A week later I toured a new house which was finished. 2.4 million rmb ($384,000) was the final price. It was being rented for 3000 rmb ($480) per month. Oh, and by the way, I am told the law states that the buyer can only own the house for 70 years.

As I shopped around all I saw was new construction tailored to those with some serious money. A large percentage of buyers are investing rather than living in what they purchase. I had a nagging question in my mind; why is no one building starter houses for those with a smaller down payment, but the ability to meet a mortgage payment of 2200 rmb ($352). Where is George Bailey? Is Mr. Potter the only game in town? The rich will buy and all others will rent?

We read reports every week about the decline in construction within China. Commodity prices are falling due to decreased demand. Reports about ghost cities and falling real estate prices abound. Recently a 29 year old entrepreneur was discussing with me his plan for moving up to one of the 1.5 million rmb ($240,000) houses. He will sell his current house which is in a good location and use the 300,000 rmb ($48,000) profit to help give him the proper down payment. When I asked him about the time frame for this big move up he smiled. Prices on new construction are coming down, he said. I will wait till they come down to bargain levels.

It is apparent that the market will sort this out. Prices will come down and more people will be able to afford to enter the market. Or so it seems. When I proposed to an economics professor a combination of factors which would soften the hard landing of the real estate bubble he agreed that they would help. “But”, he responded, “We never know what those in charge will mandate. For that we need divination, not economic science.” I am watching carefully to see if the next big thing in Chinese real estate is the construction of starter houses for those who are actually ready to live in the house they buy. This is potentially a massive market.

And finally, as my conversation with the 29 year old entrepreneur was drawing to a close he leaned forward to give me some advice. “Poor people use banks to save money. Smart people borrow from the banks in order to make money.” I responded with my most astonished, “Really?” Inside I was thinking that, yes, I did waste my time reading books about the communist economic system. In China it looks a whole lot like capitalism.

Casey Stengel

07-01-2014

China is such an interesting residential building environment. I used to go there in the late 1990’s giving technology transfer lectures with the State of Washington and the US Dept of Commerce. There was some thought the Chinese might develop a desire for wood frame, similar to Japan. I never thought they would but there were some American dreamers. In those days there were a very few Chinese builders who were doing very high end wood frame, mainly on golf course developments. Then the Chinese government killed all golf course development in about 2004. Not sure it ever has been allowed since, but the government pushed all residential building focus into the mid-rise and high rise market. Still a lot of potential high end door and window sales for America in that market but I dropped out of those lecture trips about that time. It was obvious even then that the Chinese were real capitalist at heart. They could really sharpen a pencil.

If a few Chinese golfers make a splash on some pro tours the people here will be very proud of them and want to be like them. Maybe then those in charge will allow more courses to be built. You ought to witness the excitement over Jeremy Lin. Sports in general is becoming more important. The middle class is growing and a second generation of middle class children are growing up in an atmosphere their grandparents only dreamed about. This is what I call, “the toothpaste is out of the tube.” It’s not going back in the tube. If the right people call for new golf courses, there will be new golf courses.